What to Know Before Starting to Budget

Budgeting is an essential skill for financial success. It allows you to plan and allocate your money wisely, making sure that you have enough for your needs and wants. However, budgeting can be a daunting task, especially if you’re new to it. Many people start budgeting without knowing the basics, and this often leads to frustration and failure. In this article, we’ll discuss what to know before starting to budget, so you can set yourself up for success and achieve your financial goals.

The Importance of Budgeting

Before we dive into the things you need to know before budgeting, let’s first understand why budgeting is important.

First and foremost, budgeting helps you take control of your finances. It allows you to see where your money is coming from and where it’s going. By tracking your expenses, you can identify areas where you’re overspending and make adjustments accordingly.

Budgeting also helps you save for the future. By setting aside a certain amount of money each month for savings, you can build an emergency fund and prepare for long-term goals, such as buying a house or retiring comfortably.

Moreover, budgeting gives you peace of mind. With a budget in place, you know that you have enough money to cover your expenses, and you’re less likely to go into debt or run into financial problems.

Things to Know Before Starting to Budget

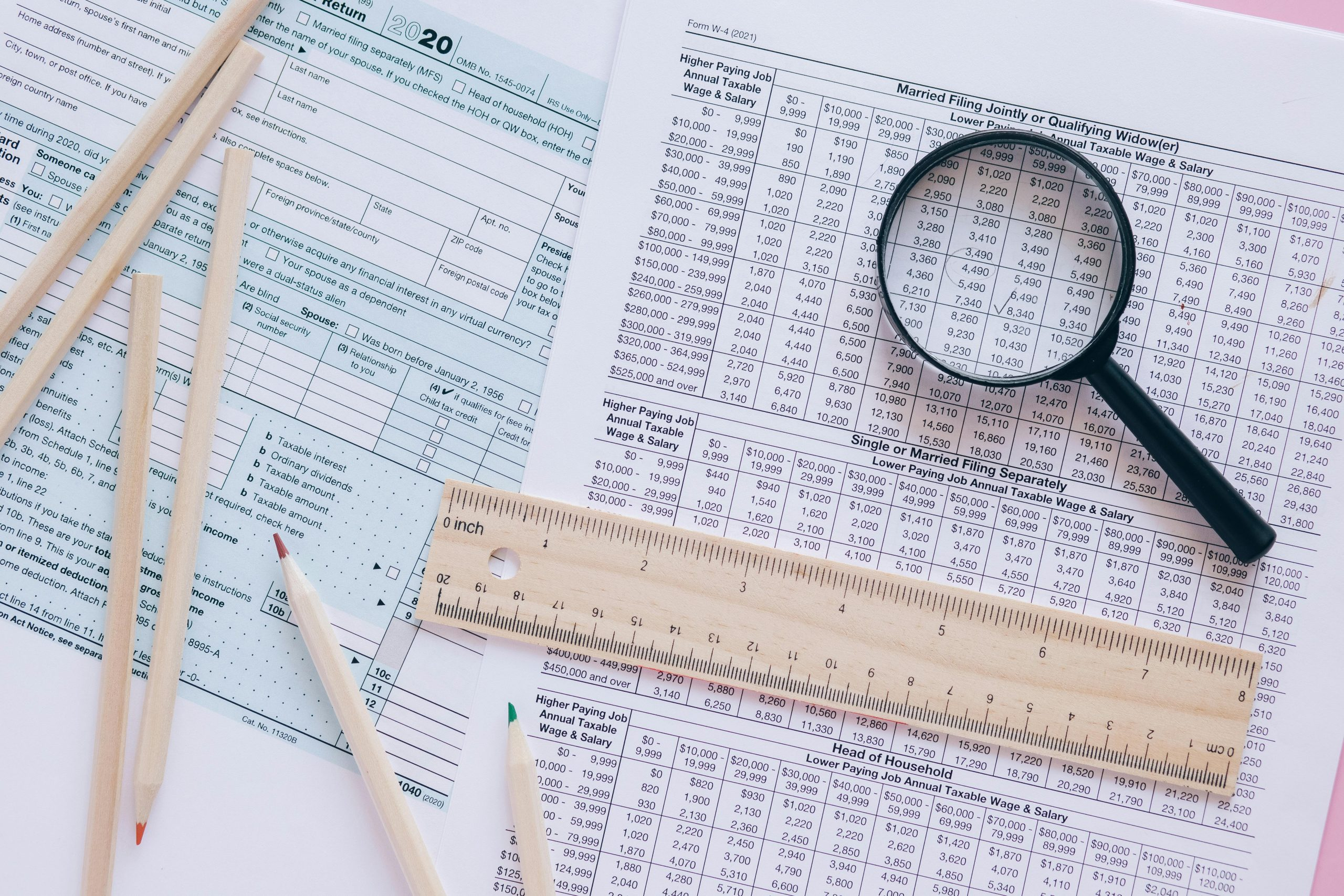

Your Income and Expenses

The first thing you need to know before starting to budget is your income and expenses. Your income refers to the amount of money you receive each month, including your salary, commissions, and any other sources of income. Your expenses, on the other hand, are all the things that you need to pay for, such as rent, food, utilities, and debt payments.

Make a list of all your sources of income and all your expenses for the past few months. This will give you a good idea of how much money you have coming in and how much you’re spending. If you notice that your expenses are higher than your income, you’ll need to find ways to reduce your spending or increase your income.

Your Financial Goals

Another important thing to know before budgeting is your financial goals. What do you want to achieve in the short-term and long-term? Do you want to save for a vacation, pay off your student loans, or retire early?

Having clear financial goals will help you prioritize your spending and make informed decisions when creating your budget. It will also motivate you to stick to your budget and make sacrifices when needed.

Your Spending Habits

It’s essential to examine your spending habits before starting to budget. Are there any unnecessary expenses that you can cut back on? Do you have any expensive habits, such as eating out or buying designer clothes, that you need to control?

Identifying your spending habits can help you make necessary adjustments and find ways to save money. For example, if you tend to overspend on shopping, you can set a strict budget for yourself and avoid impulsive purchases.

Be Realistic

When creating a budget, it’s crucial to be realistic. If you set unrealistic goals for yourself, you’ll likely become discouraged and give up on budgeting altogether.

Consider your income, expenses, and financial goals when creating your budget. Don’t try to cut back on all your expenses at once and limit yourself to eating only beans and rice. Instead, aim for small, achievable goals that will allow you to maintain your lifestyle while still saving money.

Be Flexible

While it’s essential to have a budget, it’s also important to be flexible. Unexpected expenses or changes in your income may occur, and you need to be ready to adjust your budget accordingly.

Include a small buffer in your budget for emergencies or unexpected expenses. And if you receive a bonus or a raise at work, consider putting a portion of it towards your financial goals.

Track Your Progress

Lastly, make sure to track your progress. Revisit your budget regularly to see if you’re sticking to it and if you need to make any adjustments. There are plenty of budgeting tools and apps available that can help you track your expenses and monitor your progress.

In Conclusion

Budgeting is a crucial aspect of financial management. By knowing your income and expenses, setting clear financial goals, and understanding your spending habits, you’ll be better equipped to create a realistic and effective budget. Remember to be flexible and track your progress, and with time, budgeting will become a crucial part of your financial success.